When it comes to financial health, understanding your common net worth is like having a personal scorecard for success. It’s not just about how much money you have in the bank or the shiny car parked outside your house – it’s about the big picture. Your net worth is essentially what you own minus what you owe, and it’s one of the most important financial metrics to measure where you stand. But don’t worry, we’re here to break it down in a way that makes sense, even if numbers aren’t exactly your thing.

Let’s be real, people often shy away from talking about money because it can feel awkward or taboo. But here’s the thing – if you don’t understand your net worth, you’re flying blind when it comes to building wealth. Think of it like going on a road trip without a map – sure, you might eventually get somewhere, but it’s gonna take a lot longer and be way more stressful than it needs to be.

So, buckle up because we’re about to dive deep into the world of common net worth. By the end of this, you’ll not only know what it is but also how to calculate it, improve it, and use it to set yourself up for financial success. And hey, if you’re anything like me, you’ll probably learn a thing or two along the way.

Read also:Unlocking The Secrets Of Jelly Bean Brains A Fascinating Dive Into The Science Of Sweetness

What Exactly is Common Net Worth?

Alright, let’s start with the basics. Your common net worth is basically the difference between your assets (what you own) and your liabilities (what you owe). It’s like taking a financial selfie – it gives you a snapshot of your current financial situation. And while the term "net worth" might sound fancy, it’s actually pretty straightforward once you break it down.

Breaking Down the Components

Here’s the deal – your assets include everything from your savings account and investments to your house and car. Liabilities, on the other hand, are things like mortgages, student loans, credit card debt, and any other money you owe. To calculate your net worth, you simply subtract your liabilities from your assets. Easy peasy, right?

- Assets: Savings, investments, property, vehicles

- Liabilities: Mortgages, loans, credit card debt

Now, here’s where it gets interesting. Your net worth can be positive or negative. If your assets outweigh your liabilities, you’ve got a positive net worth. But if your liabilities are higher than your assets, well, you’ve got some work to do. And that’s totally okay – understanding where you stand is the first step towards improving your financial situation.

Why Does Common Net Worth Matter?

So, why should you care about your common net worth? Well, it’s like the foundation of your financial house. If the foundation is weak, the whole thing could come crumbling down. But if it’s strong and solid, you’re setting yourself up for long-term success.

Your net worth is a key indicator of your financial health. It helps you understand where you are right now and where you need to go. Think of it like a fitness tracker for your money – it gives you insights into your progress and helps you make better decisions moving forward.

Plus, having a clear understanding of your net worth can help you set realistic financial goals. Whether you’re saving for a house, planning for retirement, or just trying to pay off debt, knowing your net worth is a crucial part of the process.

Read also:Yara Shahidi Net Worth The Rising Stars Journey To Success

How to Calculate Your Common Net Worth

Alright, let’s get practical. Calculating your common net worth is simpler than you might think. All you need is a pen, some paper, and maybe a calculator if you’re feeling fancy. Here’s how you do it:

Step 1: List Your Assets

Start by writing down everything you own that has monetary value. This includes:

- Cash in savings and checking accounts

- Investments like stocks, bonds, and retirement accounts

- Real estate properties

- Vehicles

- Valuable possessions like jewelry or collectibles

Once you’ve got everything listed, add it all up to get your total assets.

Step 2: List Your Liabilities

Next, write down all the money you owe. This includes:

- Mortgages

- Student loans

- Credit card debt

- Car loans

- Any other outstanding debts

Add these up to get your total liabilities.

Step 3: Do the Math

Now, subtract your total liabilities from your total assets. The number you end up with is your common net worth. If it’s positive, congrats! You’re on the right track. If it’s negative, don’t panic – there are plenty of ways to improve it.

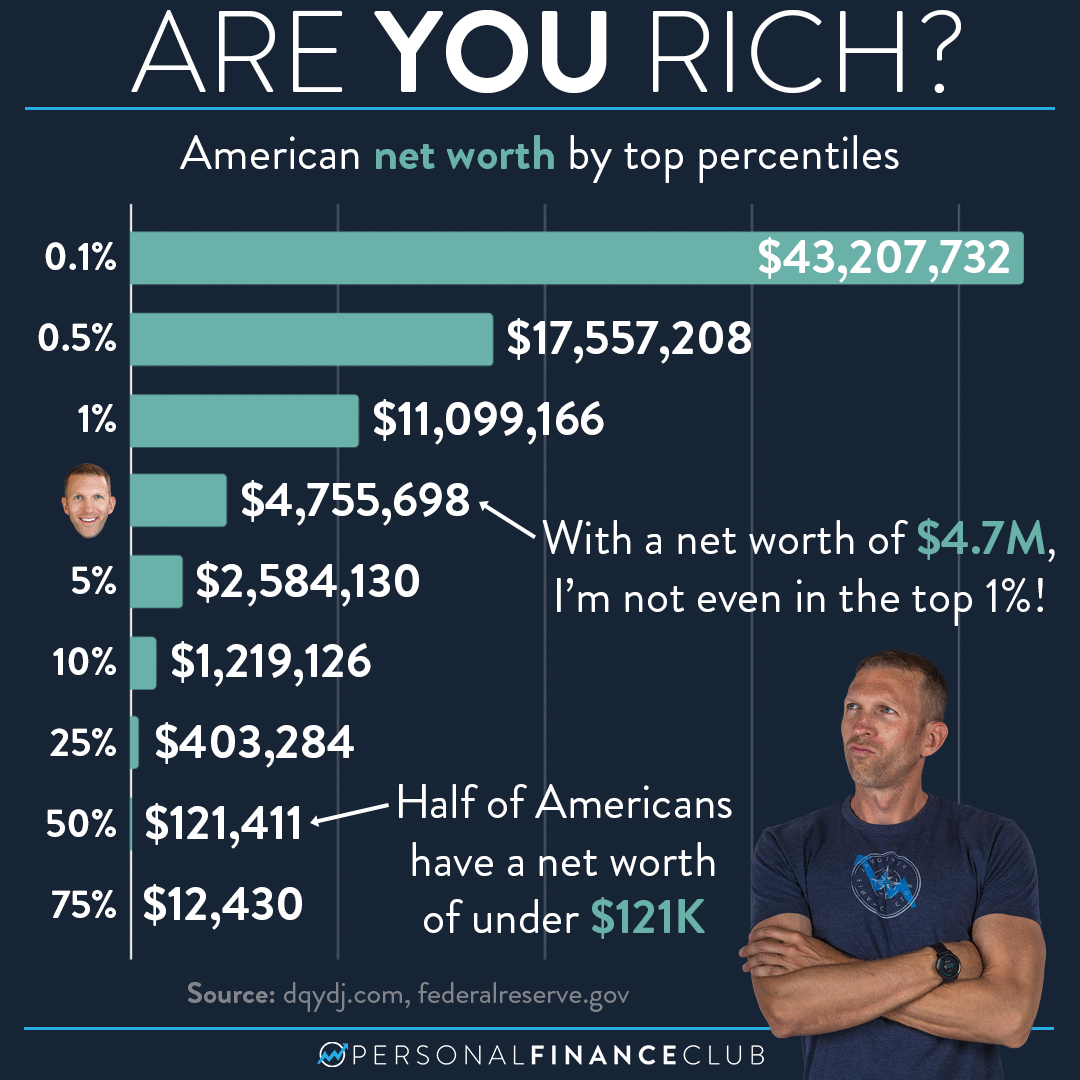

Average Common Net Worth by Age

So, how does your net worth stack up against others your age? According to recent data, the average net worth varies significantly depending on your age group. Here’s a quick breakdown:

- Under 35: $76,200

- 35-44: $288,700

- 45-54: $727,700

- 55-64: $1,167,400

- 65+: $1,066,000

Keep in mind, these are just averages. Your individual net worth can vary based on a number of factors, including income, location, and lifestyle choices.

Common Misconceptions About Net Worth

There are a few common misconceptions about common net worth that we need to clear up. First, having a high income doesn’t automatically mean you have a high net worth. If you’re spending more than you earn, your liabilities could outweigh your assets, leaving you with a negative net worth.

Another misconception is that net worth is only important for wealthy people. The truth is, everyone should be paying attention to their net worth, regardless of their income level. It’s a crucial tool for understanding your financial situation and planning for the future.

Ways to Improve Your Common Net Worth

So, how can you improve your common net worth? Here are a few strategies to consider:

1. Increase Your Income

One of the most straightforward ways to boost your net worth is to increase your income. This could mean asking for a raise, taking on a side hustle, or investing in education to improve your earning potential.

2. Reduce Your Expenses

Cutting back on unnecessary expenses can help you save more money, which you can then use to pay off debt or invest in assets. Even small changes, like canceling unused subscriptions or cooking at home more often, can make a big difference over time.

3. Pay Off Debt

Reducing your liabilities is a key part of improving your net worth. Focus on paying off high-interest debt first, like credit card balances, and then work your way down to lower-interest debts.

4. Invest Wisely

Investing is one of the most effective ways to grow your wealth over time. Whether you’re investing in stocks, real estate, or retirement accounts, make sure you’re doing it in a way that aligns with your financial goals and risk tolerance.

Common Net Worth and Retirement Planning

When it comes to retirement planning, your common net worth plays a crucial role. The more you have saved and invested, the more comfortable your retirement years are likely to be. That’s why it’s important to start planning early and make regular contributions to your retirement accounts.

Remember, your net worth isn’t just about the money you have today – it’s about the money you’ll have tomorrow. By building a strong financial foundation now, you’re setting yourself up for a secure and comfortable retirement in the future.

Common Net Worth and Financial Independence

Financial independence is the ultimate goal for many people, and your common net worth is a key factor in achieving it. The more assets you have and the fewer liabilities you carry, the closer you are to being financially independent.

Financial independence means having enough money to cover your expenses without relying on a traditional job. It’s about having the freedom to choose how you spend your time and pursue your passions. And while it might seem like a distant dream, with the right strategies and a solid understanding of your net worth, it’s definitely achievable.

Conclusion: Take Control of Your Common Net Worth

So, there you have it – a comprehensive guide to understanding and improving your common net worth. Remember, your net worth is just a number, but it’s a number that can have a big impact on your financial future. By calculating your net worth regularly, making smart financial decisions, and staying focused on your goals, you can build a strong financial foundation that will serve you well for years to come.

Now, it’s your turn. Take a few minutes to calculate your net worth and see where you stand. And don’t forget to share this article with your friends and family – the more people who understand the importance of net worth, the better off we all are. Together, we can create a more financially literate world, one person at a time.

Table of Contents

- What Exactly is Common Net Worth?

- Why Does Common Net Worth Matter?

- How to Calculate Your Common Net Worth

- Average Common Net Worth by Age

- Common Misconceptions About Net Worth

- Ways to Improve Your Common Net Worth

- Common Net Worth and Retirement Planning

- Common Net Worth and Financial Independence

- Conclusion: Take Control of Your Common Net Worth