Alright, listen up, folks. If you're scratching your head wondering, "94000 a year is how much an hour," you're not alone. Many of us get that annual salary figure tossed at us during job offers, but breaking it down into something more tangible—like hourly wages—can feel like solving a math puzzle. So, buckle up, because we're about to break this down in a way that even your high school math teacher would approve of. And trust me, this isn't just about numbers—it's about understanding your worth and planning your finances like a pro.

Now, here's the deal. Whether you're negotiating a new salary or just trying to figure out where your money is going, knowing how much you make per hour is crucial. It’s not just about paying the bills; it’s about making informed decisions about your time and money. So, let's dive right into it and answer the burning question: "94000 a year is how much an hour?" Spoiler alert: it's simpler than you think.

Before we jump into the nitty-gritty, let's establish one thing: understanding your salary isn’t just about crunching numbers. It’s about empowering yourself to make smarter financial choices. Whether you're saving for a dream vacation, paying off debt, or just trying to keep up with the Joneses, knowing your hourly rate can be a game-changer. So, grab a cup of coffee, and let's get started.

Read also:Hot Women On Fox News The Faces Shaping The Conversation

Why Knowing Your Hourly Wage Matters

Let’s face it, folks. Money talks, and knowing your hourly wage is like having a secret weapon in your financial arsenal. When you break down your annual salary into an hourly rate, you gain clarity on how much your time is truly worth. This isn’t just about bragging rights at the water cooler—it’s about making smarter decisions about your career and finances.

For instance, if someone offers you a side gig or an overtime opportunity, knowing your hourly rate helps you decide if it’s worth your time. Plus, it gives you a clearer picture of how much you need to save or invest to reach your financial goals. So, whether you're aiming for early retirement or just trying to keep your head above water, understanding your hourly wage is key.

And let’s not forget the psychological boost. Knowing exactly how much you make per hour can be incredibly motivating. It’s like having a financial barometer that tells you, "Hey, you're doing great!" So, if you’ve ever wondered, "94000 a year is how much an hour," stick around because we’re about to spill the beans.

Breaking Down the Math: How to Calculate Hourly Wage from Annual Salary

Alright, let’s roll up our sleeves and get into the math. Calculating your hourly wage from an annual salary might sound intimidating, but trust me, it’s easier than figuring out why your Wi-Fi keeps cutting out. To answer the question, "94000 a year is how much an hour," we need to break it down step by step.

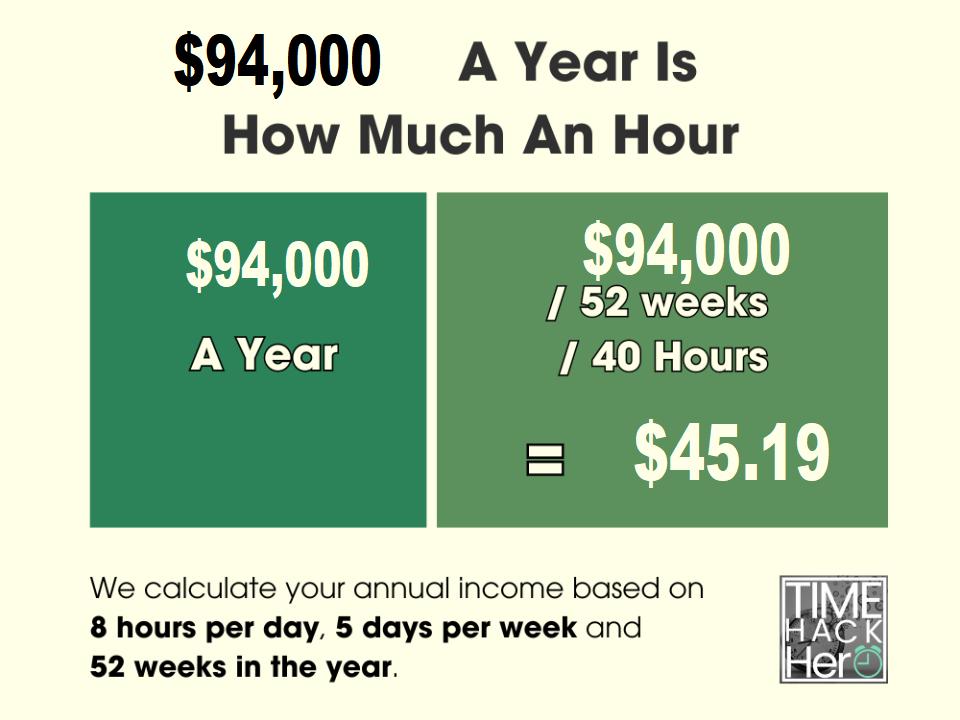

First things first: let’s assume you work a standard 40-hour workweek. Multiply that by 52 weeks in a year, and you get 2,080 working hours annually. Now, take your annual salary—$94,000—and divide it by 2,080. Boom! You’ve got your hourly wage. Spoiler: it’s approximately $45.19 per hour. Not bad, right?

But wait, there’s more. If you work part-time or have a non-standard schedule, the math might look a little different. That’s why it’s important to tailor the calculation to your specific situation. And hey, if math isn’t your strong suit, don’t worry. We’ve got you covered with some handy tips and tricks to make this process a breeze.

Read also:The Skinniest Lady In The World Her Story Facts And Inspiring Journey

Tips for Accurate Salary Conversion

Here are a few quick tips to ensure your calculations are on point:

- Double-check your annual salary figure to make sure it’s accurate.

- Account for any unpaid leave or vacation days that might affect your total working hours.

- If you work overtime or have variable hours, adjust your calculations accordingly.

- Don’t forget to factor in taxes and deductions, which can impact your take-home pay.

By following these tips, you’ll have a clearer picture of your hourly wage and how it fits into your overall financial plan. Now, let’s move on to the next big question: how does this hourly wage compare to industry standards?

Comparing Your Hourly Wage to Industry Standards

So, you’ve figured out that $94,000 a year translates to roughly $45.19 per hour. But how does that stack up against industry standards? The truth is, it depends on your field, location, and level of experience. For example, if you’re in tech or finance, $45.19 per hour might be on the lower end. But if you’re in retail or hospitality, it could be considered above average.

According to data from the U.S. Bureau of Labor Statistics, the median hourly wage across all occupations is around $20.16. That means if you’re making $45.19 per hour, you’re doing pretty well compared to the average worker. But here’s the kicker: location matters. In cities like New York or San Francisco, that hourly rate might not stretch as far as it would in smaller towns or rural areas.

And don’t forget about benefits. While your hourly wage is important, it’s not the only factor to consider. Health insurance, retirement plans, and paid time off can significantly impact your overall compensation package. So, when comparing your wage to industry standards, make sure you’re looking at the full picture.

How Location Affects Your Hourly Wage

Let’s talk about location for a second. If you live in a high-cost-of-living area, your $45.19 per hour might not feel as substantial as it would in a place with a lower cost of living. For example, according to Numbeo, the cost of living in San Francisco is about 50% higher than in a city like Houston, Texas. That means your money might not stretch as far, even if your hourly wage is the same.

But here’s the good news: some companies offer location-based pay adjustments to help offset these differences. So, if you’re working in a pricier city, you might see a bump in your hourly rate to account for the higher cost of living. It’s always worth asking about during salary negotiations.

Understanding the Impact of Taxes on Your Hourly Wage

Now, let’s talk about the elephant in the room: taxes. When you calculate your hourly wage from an annual salary, it’s important to remember that what you see on paper isn’t always what you take home. Federal, state, and local taxes can eat into your earnings, sometimes significantly.

For example, if you live in a state with high income taxes like California or New York, your take-home pay might be less than someone in a state with no income tax, like Texas or Florida. And don’t forget about Social Security and Medicare taxes, which apply to everyone. These deductions can reduce your hourly wage by several dollars.

But here’s the silver lining: understanding how taxes affect your hourly wage can help you plan better. By factoring in these deductions upfront, you’ll have a more realistic idea of what you’ll actually bring home each paycheck. And that’s key to making smart financial decisions.

Strategies for Managing Tax Deductions

Here are a few strategies to help you manage tax deductions and maximize your take-home pay:

- Take advantage of pre-tax benefits like health insurance and retirement plans.

- Consider itemizing deductions if you have significant expenses like mortgage interest or medical bills.

- Stay informed about tax law changes that could impact your earnings.

- Consult a tax professional to ensure you’re optimizing your tax strategy.

By implementing these strategies, you can keep more of your hard-earned money in your pocket. Now, let’s move on to the next big question: how can you use this information to improve your financial health?

Using Your Hourly Wage to Improve Financial Health

Now that you know how much you make per hour, it’s time to put that knowledge to work. Understanding your hourly wage isn’t just about knowing how much you earn—it’s about using that information to improve your financial health. Whether you’re saving for a down payment on a house or building an emergency fund, your hourly wage can be a powerful tool in your financial planning arsenal.

For example, if you’re trying to decide whether to take on a side gig, knowing your hourly wage can help you weigh the pros and cons. Is the extra income worth the time and effort? If you’re already making $45.19 per hour at your main job, does it make sense to take on a side hustle that pays less? These are the kinds of questions you can answer with a clear understanding of your hourly wage.

And don’t forget about budgeting. Knowing your hourly wage can help you create a more realistic budget that aligns with your financial goals. Whether you’re trying to cut expenses or increase savings, having a clear picture of your hourly earnings can guide your decision-making process.

Creating a Budget Based on Your Hourly Wage

Here’s how you can create a budget based on your hourly wage:

- Calculate your monthly take-home pay by multiplying your hourly wage by the number of hours you work each month.

- Divide your expenses into fixed (rent, utilities) and variable (groceries, entertainment) categories.

- Set aside a portion of your income for savings and investments.

- Track your spending regularly to ensure you’re staying within your budget.

By following these steps, you’ll have a budget that’s tailored to your specific financial situation and goals. And that’s the key to long-term financial success.

Common Misconceptions About Hourly Wages

Before we wrap up, let’s address some common misconceptions about hourly wages. One of the biggest myths is that hourly workers are always paid less than salaried employees. While this might be true in some cases, it’s not a universal rule. In fact, many hourly workers earn competitive wages, especially in industries like healthcare and technology.

Another misconception is that hourly wages don’t include benefits. While it’s true that some hourly jobs might not offer the same benefits as salaried positions, many companies are starting to offer comprehensive benefits packages to attract top talent. So, don’t assume that hourly work means sacrificing perks like health insurance or retirement plans.

And finally, let’s debunk the myth that hourly wages are less stable than salaried positions. While it’s true that some hourly jobs might have variable hours, many offer consistent schedules and predictable income. It all depends on the job and the company you work for.

Addressing the Hourly vs. Salaried Debate

Let’s tackle the hourly vs. salaried debate head-on. While both have their pros and cons, it’s important to choose the option that aligns with your career goals and financial needs. If you value stability and predictability, a salaried position might be the way to go. But if you prefer flexibility and the potential for overtime pay, an hourly job could be a better fit.

Ultimately, the choice comes down to your personal preferences and priorities. Whether you’re making $94,000 a year as an hourly worker or a salaried employee, the key is to make the most of your earnings and plan for your financial future.

Conclusion: Taking Control of Your Financial Future

Alright, folks, we’ve covered a lot of ground. From breaking down the math to comparing your hourly wage to industry standards, we’ve explored everything you need to know about "94000 a year is how much an hour." And let’s be honest, knowing your hourly wage isn’t just about numbers—it’s about taking control of your financial future.

So, here’s the bottom line: understanding your hourly wage empowers you to make smarter decisions about your career, finances, and overall well-being. Whether you’re negotiating a new salary, planning your budget, or just trying to figure out where your money is going, this knowledge is invaluable.

Now, it’s your turn. Take what you’ve learned and put it into action. Whether that means creating a budget, exploring new job opportunities, or just appreciating the value of your time, the choice is yours. And remember, if you have any questions or need further clarification, feel free to leave a comment or reach out. Your financial future is in your hands, so make it count!

Table of Contents

Why Knowing Your Hourly Wage Matters

Breaking Down the Math: How to Calculate Hourly Wage from Annual Salary

Comparing Your Hourly Wage to Industry Standards